chapter 13 bankruptcy - An Overview

Chapter 13 is sometimes referred to as the wage earner’s bankruptcy, and once and for all explanation. Chapter 13 is bankruptcy for people who are producing dollars but have fallen desperately at the rear of trying to sustain with payments for things bought on credit rating.

As soon as you comprehensive the class, the company will concern you a certificate of completion, which have to be filed While using the bankruptcy court. The credit counselor is not allowed to advise you no matter whether it is best to file for bankruptcy. The bankruptcy administrator retains an index of approved corporations that supply credit counseling.

Come across an accredited credit counselor to help you weigh your choices. If you choose to shift forward with bankruptcy, you are able to employ the service of a bankruptcy attorney to assist you fill out the paperwork.

The debtor then pays an agreed-on sum of money every month for the trustee, properly consolidating the debts into one regular monthly payment. The trustee, consequently, distributes the money to the debtor's creditors. Debtors haven't any direct connection with their creditors less than Chapter 13 defense.

By clicking “Settle for All Cookies”, you conform to the storing of cookies on the gadget to reinforce web-site navigation, assess internet site usage, and assist inside our advertising efforts.

Dwelling equity financial loans Household equity loans let you borrow a lump sum at a hard and fast level, based upon the amount of the house you possess outright.

Did the debtor propose the prepare in fantastic faith? Or would be the filer hoping to govern the bankruptcy process?

Creditors can no longer connect with you in the home or at work and you may refer all creditors to us. The Regulation Offices of Fisher-Sandler, LLC will do the many function required to get you begun around the street site here to getting debt-cost-free.

Perspective all investmentsStocksFundsBondsReal estate and different investmentsCryptocurrencyEmployee equityBrokerage accounts529 faculty discounts plansInvestment account reviewsCompare on-line brokerages

The methods to get bankruptcy will rely on the situation of your respective scenario and irrespective of whether you file for Chapter seven bankruptcy or Chapter thirteen bankruptcy. To find out about the method it is possible to assume from Every single form of bankruptcy, keep reading.

Generally, the decrease your credit rating score is before you decide to file, click here for more info the considerably less of a success your score might choose. You could see your rating tumble nearly two hundred factors For those who have superb credit score.

We sustain a firewall involving our advertisers and our editorial team. Our chapter 7 bankruptcy editorial crew would not receive direct payment from our advertisers. Editorial Independence

This chapter in the Bankruptcy Code supplies for site here "liquidation" - the sale of the debtor's nonexempt property as well as the distribution on the proceeds to creditors.

By submitting for Chapter thirteen bankruptcy, they have been ready to quit the foreclosure and continue to be inside their dwelling. With their now-steady profits, they are able to pay out their house loan each and every month while Learn More Here also spreading the $twenty five,000 again payment more than a five-year period of time.

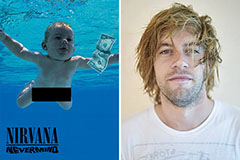

Spencer Elden Then & Now!

Spencer Elden Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Ashley Johnson Then & Now!

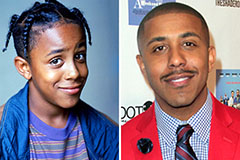

Ashley Johnson Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!